A tale of two market regimes

There is a strange dynamic emerging in crypto. Total market cap is consolidating near ATHs as the asset class gains widespread acceptance at the highest levels of finance and government. In a surprise reversal from the SEC, Ethereum ETFs are now slated to launch in July on the heels of Bitcoin’s record-breaking debut. Moreover, there is growing bipartisan support in congress to enact legislation that finally provides regulatory clarity in the US. Global stablecoin supply continues to rise.

But amongst the crypto natives, sentiment is low and infighting is high. Many loaded up on buzzy narratives and meme coins, which are down bad in Q2 (more on that in the next section). Public opinion has turned on points programs and influencers are calling for the death of the airdrop meta. Easy money is harder to find. Last quarter we wrote about how crypto culture is diverging into ‘The Computer’ and ‘The Casino’. This quarter, fortunes in the casino have started to turn.

But while many bemoan a supposed lack of opportunity, we are here to tell you that crypto is undergoing a necessary and valuable evolution. For most of its existence, crypto has rewarded average traders with a pulse on the market and a disposition to gamble. Degen culture isn’t going away, but if crypto is to become a more serious asset class, the serious assets should outperform the silly ones (at least on a long enough time horizon). That hasn’t always been the case. But as the marginal crypto investor becomes more sophisticated, the tokens with real revenue and reasonable valuations should benefit, and that is where we continue to focus.

An overdue reckoning for inflated valuations

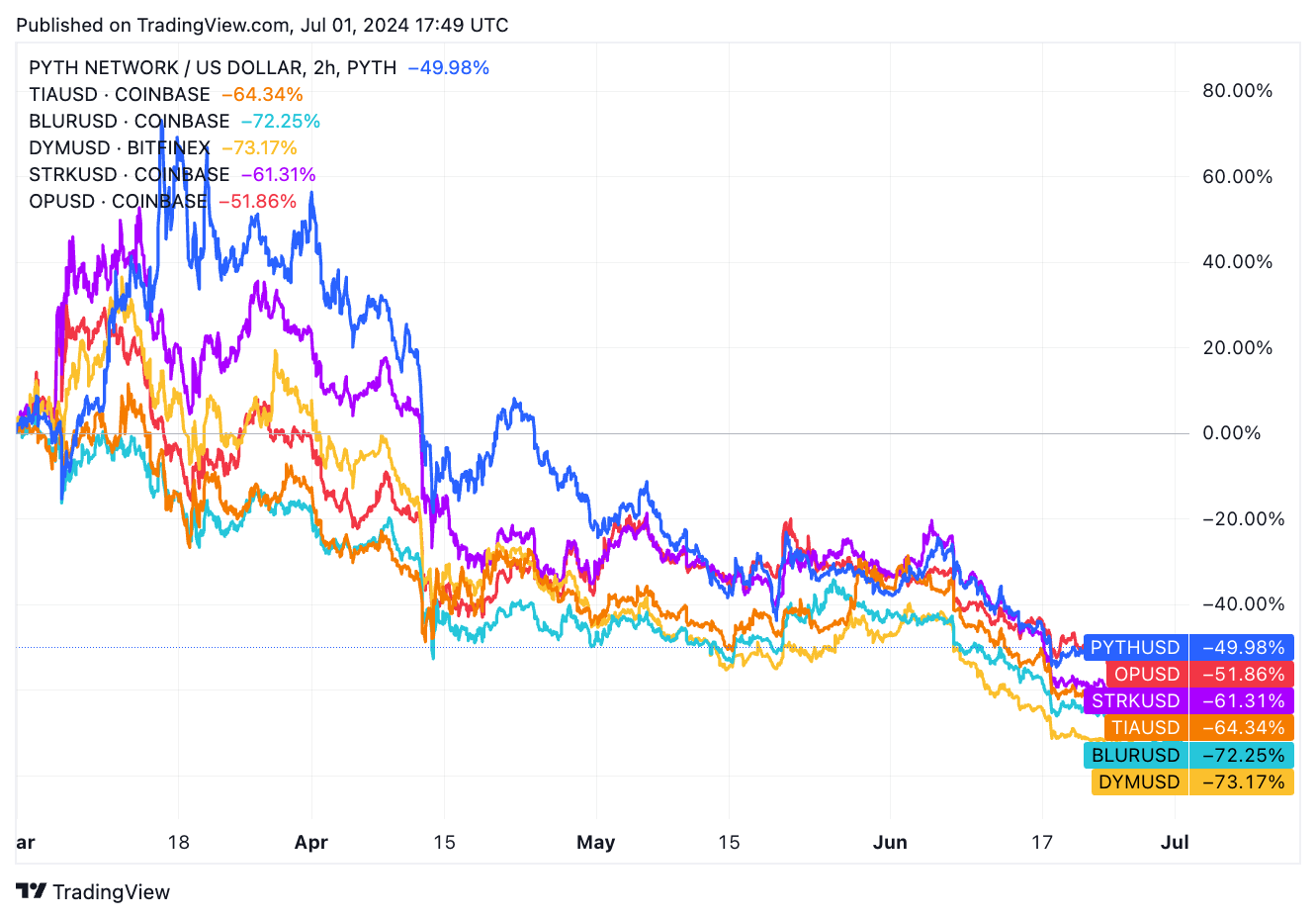

In our last report we warned that despite a run-up, the market was “still full of half-baked vaporware and predatory tokenomics”. This quarter, we watched many such projects re-rate accordingly. Here’s a thread that provides more context, along with a chart of a few of the most notable drawdowns:

For years, crypto markets have favored new coins. This makes some sense considering the ever-changing, speculative nature of the space. But it has also led to outsized valuations that have become increasingly detached from fundamental value. If you’ve been following crypto recently, you have likely heard people bemoan “low float, high FDV” launches. If not, Cobie has the definitive overview here.

In short, tokens are launching later because projects can raise more money at higher valuations from VCs that have a surplus of cash on hand. As a result, price discovery increasingly happens in private markets, which inflates valuations and shrinks the opportunity for public markets. This is exacerbated when teams launch tokens with artificially low circulating supply into public markets that have been trained to buy first and ask questions later.

This dynamic has persisted longer than it should have, but with the number of new tokens reaching all-time highs, buyers are finally exhausted.

Arbitrum: A Cautionary Tale

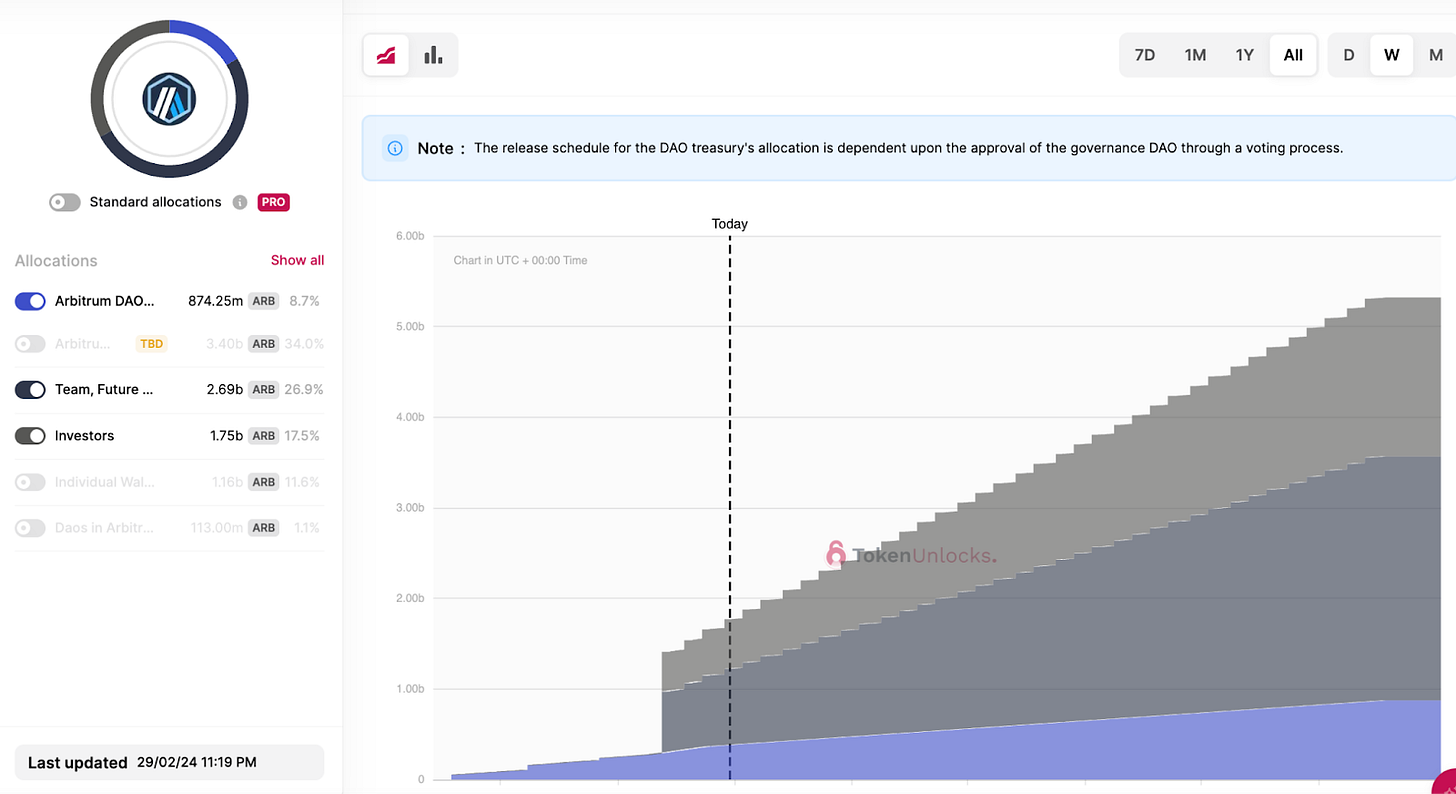

Nowhere is this more apparent than Arbitrum. After launching last year at a $10B+ valuation, Arbitrum has largely delivered on its promise as an Ethereum scaling solution. It is the most active of the myriad L2 chains with almost 30% of TVL and a plurality of active addresses. The ARB / ETH chart YTD tells a very different story:

Despite being the market leader in its category and a consensus “ETH beta” play, $ARB has badly underperformed $ETH (which is up ~50% this year). Over a year ago we said we weren’t buying Arbitrum because of the huge token unlocks that would eventually hit the market. In Q2 this year, those unlocks indeed began to hit, with almost two billion tokens released over the last few months.

What is most telling however is not the 65% haircut in price, but the fact that circulating market cap has actually increased to ~$2.5B during the same period.

Circulating market cap has increased since launch as more tokens hit the market, but there is no one left to buy unlocking tokens at such inflated prices. Arbitrum may be the poster child, but there are plenty of other offenders. Among the exciting projects which we will not be buying at current FDVs:

That is not to say these tokens will be untouchable forever. Years from now, when circulating supply converges with fully diluted valuation, it’s quite possible that these projects will have emerged as category winners while their valuations lag. Galaxy Digital recently estimated “$80B of token unlocking supply between now and 2026”, which is well more than the entire crypto hedge fund market at $20B AUM. That presents a challenge for projects and token/equity holders, but an opportunity for patient liquid funds (and a reason for venture firms to reconsider liquid alternatives). In any event, we welcome the renewed focus on quality and have been preparing accordingly.

Current focus: Defi Leaders

On the other end of the spectrum are the “OG defi tokens”, which offer:

90%+ circulating supplies after years of vesting, unlocks, and emissions

Real and growing revenue, with outstanding operating margins

An opportunity to buy the low on sentiment after years of underperformance

A history of stability and security, which should appeal to more traditional investors

Ryan Watkins at Syncracy created this terrific view (and corresponding post):

Our two favorites here are Maker ($MKR) and Lido ($LDO).

Maker started as a decentralized stablecoin issuer, but has grown to become a comprehensive money market and credit facility for on-chain activities. As a result, the project is on track to generate ~$100M in earnings this year. MakerBurn.com breaks down protocol revenues and costs, but in short it has the business model of a bank with the margins of a software company (not to mention censorship-resistance from regulatory overreach). When you start to forecast revenue growth that comes with more on-chain borrowers and a growing diversity of on-chain lending products, today’s ~$2B valuation looks inexpensive using traditional valuation metrics. We believe a long-term valuation in the tens of billions (5-20x from here) is achievable.

We have written about Lido before as a way to bet on Ethereum, and its underlying fundamentals continue to improve. Lido dominates the liquid staking category (on Ethereum) with 70%+ market share and $35B deposited. Lido currently facilitates $1.2B per year in staking fee revenue on behalf of users, 10% of which are retained by the protocol (and its validators). As the price of Ethereum increases, so too will the value of Lido earnings. There isn’t as much room to grow market share, but Lido’s category moat (a function of liquidity and partnerships) should translate to earnings durability.

Part of the reason the market values these tokens this way is uncertainty around value accrual. In both cases, a lack of regulatory clarity limits how the protocols can distribute profits. The more directly they pass along value to token holders, the closer they get to infringing on securities laws. For now, Lido retains earnings in its treasury while Maker uses profits to buy back MKR tokens on the open market.

We view these mechanisms as ‘good enough’ in the short term, but see a longer term path to updated securities laws and more straightforward economics (e.g. earnings paid out as dividend revenue to tokenholders). In that environment, we believe the enterprise value of protocols like Maker and Lido will become obvious to incoming investors looking at the space through the lens of more traditional valuation metrics. LDO and MKR have a high price floor (via earnings potential) and a higher ceiling (via a new cohort of marginal buyers), and we have accumulated large positions in both.

Uniswap ($UNI) and AAVE ($AAVE) certainly qualify as leaders in their own right, but we don’t view either token as favorably. AAVE generates and retains earnings but its product mix and growth potential are more limited than Maker. Uniswap still double dips on equity with its token governing the Uniswap protocol and a separate entity, Uniswap Labs, accruing the value of its earnings. It also faces the overhang and cost of its pending court battle with the SEC.

Elsewhere: Regulatory Winter Turns to Spring

After years of antagonism and months of negative headlines, crypto has finally reached an inflection point on the regulatory front. There is increasing bipartisan support for crypto legislation and the industry has scored several notable wins against the SEC in court. If approved, the recently introduced Payment Stablecoin Act would open up new frontiers for on-chain economies. Perhaps most surprisingly, crypto has become a major talking point in the Presidential campaign, with Trump going so far as to say that he wants Bitcoin to grow and flourish in the US. In Europe, The Markets in Crypto Assets Regulation (MiCA) is set to go live this summer, signaling the region's desire to attract and develop the industry.

At the same time, enacted legislation is far from certain. In their current form, proposed bills lack the nuance to establish a comprehensive framework. The Biden administration continues to treat the industry with skepticism and hostility despite growing, widespread support. Gary Gensler and the SEC are still on a warpath against entrepreneurs in the US.

On balance, progress towards clarity and credibility is unmistakable. Starting with the financial industry and now the political apparatus, it has become clear that blockchains are not going away and the industry is a formidable interest group. That realization warrants regulation if not admiration.

Cycle timing: Where do we go from here?

Recent price action may not reflect, but real adoption continues in financial, corporate, and regulatory sectors. On the macro front, rate cuts seem inevitable and fears about the deficit and fiat debasement continue to swell. We have discussed the link between money supply and crypto prices before, and will be watching the Global Liquidity Index, which is set to increase after bottoming last year.

We are not blind to potential short-term bearish catalysts – including government liquidations (e.g. Germany, US), rumors of a Mt Gox distribution, and the possibility of higher rates for longer if inflation persists. However, all of these look like short term noise relative to the signal of global adoption. All roads lead to more liquidity, more debt, and asset inflation – with digital assets leading the way. It is still an excellent risk-adjusted time to enter the market if you are still on the sidelines.

If you do enter the market, do not discount the probability of volatility. There have been six drawdowns of 20%+ in the last 18 months, and we would expect more of the same even in a bull run. Overtrading volatility is a quick way to deplete capital. We are happy to sit in long-term positions and wait for opportunities to buy quality assets at distressed prices as the next cohort of buyers develops.

Final word on positioning and performance

Given the sideways market and relative outperformance of majors versus alts, our performance fell back in Q2. Our plan stays the same, however, and we continue to use sell-offs to rotate out of profitable major positions and into high-conviction alts at favorable valuations in advance of an inevitable rise. The stalwarts of a new economy are becoming clear to those who take the time to look. As always, reach out if you have feedback!